Christmas Unwrapped: What Do Consumers Want This Christmas?

It’s officially autumn and while it might not be time to start on the mince pies just yet, it’s definitely time to talk about what Christmas 2024 has in store for consumer brands.

To find out how UK consumers are feeling about their personal finances, and the implications this has for the way they’ll choose to spend their money this festive season, we conducted research exploring their thoughts on everything from why they follow brands on social, to where they plan to do their Christmas shopping.

You can download the report for more detail about what consumers told us. But first, here are five key findings suggesting cause for cautious optimism.

1. People Are Concerned about COsts, But Do Have Money to SPend

We’ve not had an easy run of Christmases in recent years. But the picture is improving.

While 70% of respondents expressed some level of concern about the cost of living, certain groups are more conscious of those concerns than others, peaking among parents with dependent children living at home (79%) and those in mid-life (75% of 35-44s).

However, over half of our respondents say they’re either able to cover essential bills and have money to save or spend on non-essentials, or are comfortable enough to not worry about what they spend. A message further emphasised by the fact that 62% said they’ll have the same – or more – money to spend this Christmas compared to last.

While this offers hope for brands that have weathered an exceptionally challenging period, lingering concerns surrounding increased prices and the imminent budget, means people are still watching where and how they spend.

2. Family, Fun and Food are the FEstive Priorities

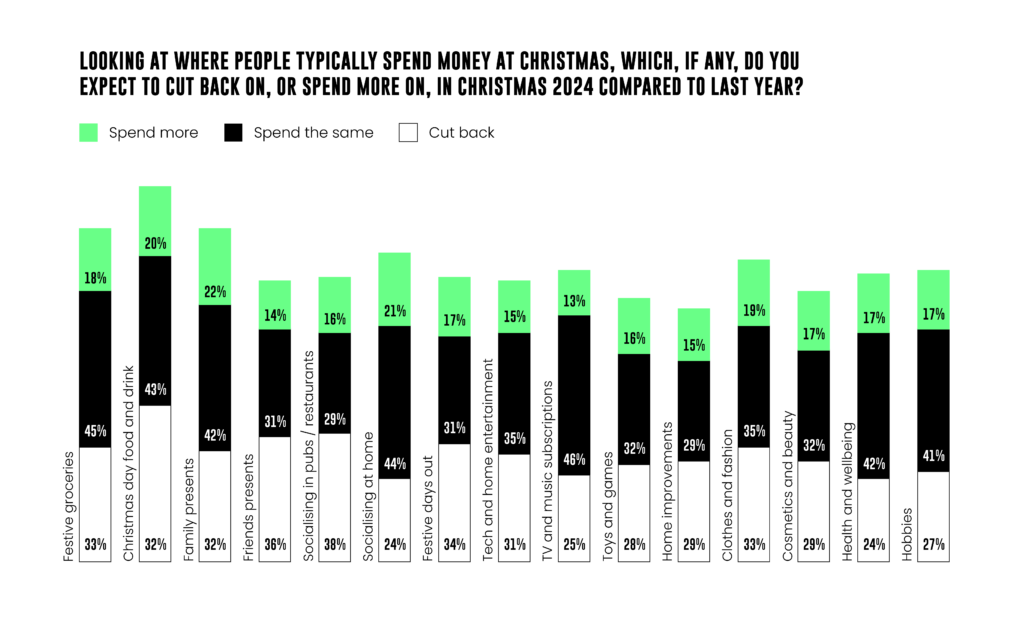

Our findings suggest people will be prioritising the festive staples of food and drink (63% spending the same or more than last year), socialising at home (65%), and gifts for relatives (63%).

Even in the areas that look likely to take a bit more of a hit, such as socialising in pubs where 38% expect to cut back to some degree, there are pockets of positive news. For example, over half of 16-24s actually expect to spend the same or more than last year on going out.

Similarly, although 34% of respondents expect to reduce their spending on days out over the festive period, 59% of 16-24s and 56% of 25-34s intend to spend the same or more. It’s also worth noting that this trend towards spending the same or more is apparent for parents with children under 18, suggesting the family market is looking for entertaining ways to spend time together over Christmas and twixmas.

3. There’s an Appetite for Mood-Boosting Purchases

Alongside the expected areas of family and food and drink, our research suggests an interest in purchases which enhance wellbeing.

In fact, 70% of 16-24s are planning to spend the same or more than last year on health and wellbeing, with the same being true for 67% of 25-34-year-olds. We can also see a similar enthusiasm for health and wellbeing among groups including parents with children under 18 (65%), full time workers (66%) and higher earners (74%), suggesting a variety of audiences receptive to messaging around things that will help them look after themselves this festive period.

Cosmetics and beauty treatments also bucked the trends when we look at specific age groups, with 66% of 16-24s saying they’ll spend to the same or more – and the figure for 25s-44s just under 60%.

4. Saving and Spending For Christmas

While 33% of the people we asked said they don’t specifically save for Christmas, we saw a broad spread of saving habits across the year, with 9% starting as early as January and 13% beginning to set money aside in September. Women are more likely than men to save, younger age groups are more likely to save and the over 55s are the least likely to be saving specifically for Christmas-related spending.

When it comes to starting the Christmas shopping, our research suggests that some stereotypes might just be true, with 17% of men saying they will start shopping in December, versus just 6% of women.

The largest proportion of people – 26% – will start shopping in November, suggesting many are waiting for the discounts and offers associated with trading around Black Friday.

5. People Are Looking for Gift Inspo Online and In-store

When we asked people where they’re going to look for inspiration ahead of their Christmas shopping this year, brand websites (30%) and online adverts (27%) ranked highly. But it was in-store displays that topped the list with 33% of consumers mentioning this as a source of inspiration.

That said, we can see distinct differences in where people are searching for ideas when we look at different age groups. For example 41% of 16-24-year-olds will be turning to TikTok, with Instagram and Facebook also proving popular among the 25-34 and 35-44 age groups.

This pattern of blending digital and bricks and mortar research, was also seen in how people intend to do their shopping this year. A third of our respondents intend to split their shopping equally between in-store and online purchasing.

In Summary

While the picture isn’t entirely rosy as we enter the golden quarter, there are signs this could be a better Christmas than we’ve experienced over the last few years.

To some extent, people are adjusting to the increased cost of living and adapting their spending habits to accommodate it. And if ever there’s a time for loosening the purse strings, Christmas is it.

Find out more about what our research has revealed, and our ten key pieces of advice about how to apply these insights to consumer PR, social, and communications activity, in our full report – available to download below.

WPR is an award-winning PR agency, based in Birmingham, renowned for getting the world talking about the brilliant brands we work with. We specialise in consumer PR, across sectors including food and drink, retail and leisure; B2B PR, where we work with companies spanning manufacturing, construction and HVAC industries; and social media.

To start a conversation about how we can get the world talking about your business, please get in touch – we’d love to chat.