Christmas Unwrapped: Consumer Spending in 2025

The fairy lights are up, the Christmas tunes are on repeat, mince pies are being eaten, and it’s almost time to bid farewell to 2024, a year that some may be happy to see the back of. For many consumers – and the brands that sell to them – 2024 has been a difficult year, dominated by uncertainty surrounding the UK and US elections and ongoing high living costs.

When we talked to consumers about their spending plans for Christmas, we also explored their thoughts about what the new year might hold. So, how confident are consumer feeling about their future finances and what are their spending priorities for 2025?

are consumers confident about their 2025 finances?

We uncovered a mixed picture around people’s confidence in the state of their household finances for 2025. Just over half (52%) of our respondents said they expect their financial situation to either remain the same or to be better off in the new year. However, over a third (37%) are expecting to be worse off.

The most optimistic responses came from younger age groups. We saw 70% of 25-34-year-olds and 63% of the 35-44yrs category responding more positively, a trend also seen in research by PWC, which shows greater positive sentiment from the under 25s . In recent weeks, GfK’s consumer confidence survey has offered further glimmers of hope, pointing to a upward tick in November as people put the uncertainty of elections and the budget behind them and look forward. While things are far from rosy yet, and there are concerning indicators around the jobs market post-budget, there remains the possibility of some pockets of potential in the new year for the brands that can tap into those least impacted by wider economic pressures.

CONSIDER A BESPOKE APPROACH TO Q5

Before we even get into the new year, we need to ask whether we’re maximising the opportunities during the so-called “Q5” period. This is a slightly painful term being used by some to refer to that brief twixmas/early new year period when people are still in a festive mood, are more likely to be off work, and are on the hunt for post-Christmas bargains or treats.

Whatever you call it, there’s merit in thinking about this window as an opportunity with its own specific characteristics. Christmas present and food shopping for the big day is all done and dusted, but the reality of everyday life hasn’t yet resumed.

Tapping into this idea, TikTok has published a guide to help marketers reach the users it says are actively seeking trends, deals and new products. In fact, TikTok says that while holiday-specific content declines post-Christmas, shopping-related content gets a boost and doesn’t peak until January.

With our research revealing that 41% of 16-24-year-olds, and 30% of 25-34-year-olds are using TikTok for shopping inspiration, and that Instagram and Facebook are also key shopping resources for the under 45s, it’s clear there will be a ready and willing audience scrolling on phones, trawling websites and looking for entertaining ways to fill precious days off.

So as the big seasonal campaigns wind down, there are chances to both secure press coverage and to adjust your organic social or paid campaign activity. For consumer PR mileage, think product guides to the sales, or anything related to new year’s resolutions to feed the acres of print and digital space that will be devoted to these topics post-Christmas. And the beauty of social content and paid campaigns, is the scope they offer to be agile (don’t miss our tips for supercharging your paid activity this Christmas and new year). Ultimately, make sure you’re adjusting your activity and messaging to connect with the mood of your audience during this short-lived, but potentially underrated, phase of the annual cycle.

WHAT ARE CONSUMER SPENDING PLANS FOR 2025?

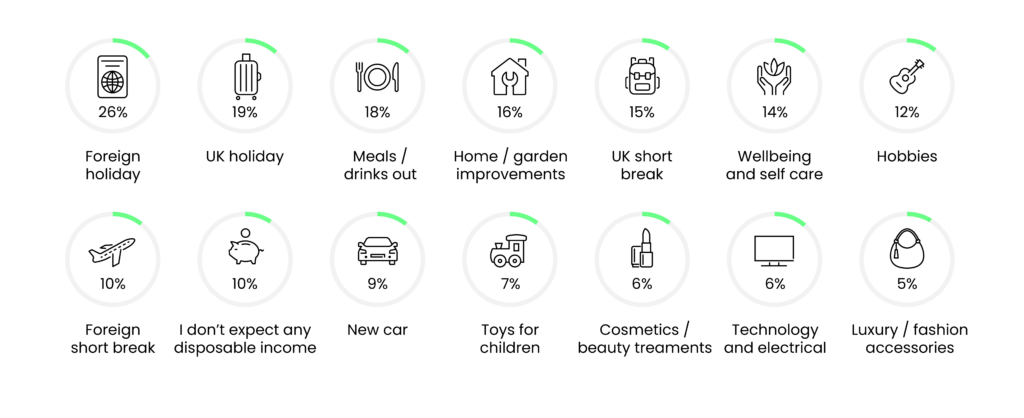

So, what will consumers be looking for from brands in 2025? Our research suggests that escapism and wellbeing is going to be top of people’s wish lists for the new year.

Over a quarter of all age groups put foreign holidays as their top priority, with UK holidays not far behind. Meals and drinks out, home and garden improvements, UK short breaks, and wellbeing and self-care were the next most popular choices.

In the youngest age groups (16-24), meals and drinks out took the top spot (24%), highlighting potential for leisure and hospitality brands. Armed with the knowledge that almost 30% of this group expect to be better off in 2025 (a further 30% expect no change to their finances), and that they’re looking for hospitality and leisure brands to deliver social content that is entertaining (40%), there is real scope for brands that craft social-first campaigns which resonate with this active, engaged audience.

At the other end of the age spectrum, the over 55s are particularly interested in foreign travel, with 29% giving this as their priority. For this age group, spending money on home and garden improvements, and on other hobbies, were next on their wish lists. While they’re less likely to follow brands on social media, there is an active online community seeking discounts/offers, information about new products or services, and informative content. Our research also shows this age group is particularly likely to listen to recommendations from friends and family, emphasing the value in building awareness and reputation to feed into positive word of mouth.

Interest in wellbeing and self-care appears important to all the under 44s, peaking with the 35-44 group who rated it as their third priority (after foreign and UK holidays). This aligns with TikTok’s insights that show an increase in interest in ‘self-care’ and ‘treat’ related content post-Christmas as consumers’ thoughts turn to wellbeing, self-improvement, as they attempt to stick to their new year’s resolutions (at least for January!).

This desire for experiences and products that offer escapism and a sense of wellbeing (since holidays, short-breaks, and time spent with friends and family having meals and drinks out surely all contribute to wellbeing) gives consumer marketers a clear indication of the messages that will appeal to audiences as the new year gets underway.

Want to

know more?

DOWNLOAD YOUR FREE INSIGHT REPORT

For more insight about what consumers are looking for from the brands they choose, their priorities for the new year, and what this means for 2025 marketing plans, download WPR’s consumer insight report Christmas Unwrapped.

WPR is an award-winning PR agency, based in Birmingham, renowned for getting the world talking about the brilliant brands we work with. We specialise in consumer PR, across sectors including food and drink, retail and leisure; B2B PR, where we work with companies spanning manufacturing, construction and HVAC industries; and social media.

To start a conversation about how we can get the world talking about your business, please get in touch – we’d love to chat.